This report explains what Ubisoft is going through right now and why it matters to players, teams, and investors. It focuses on verified, public information from official releases, earnings materials, and on-the-record statements. It also explains how current business choices affect games on your screen, from live updates to the slate ahead.

Most sections use only verified facts. One section, clearly labeled Rumors and Market Chatter, summarizes widely reported but unconfirmed items and treats them with caution.

Company Snapshot And Where Ubisoft Stands

Ubisoft is a global publisher and developer with studios across North America, Europe, and Asia. It is known for large open world series and service-driven games. Core brands include Assassin’s Creed, Rainbow Six, Far Cry, The Crew, and Just Dance. Ubisoft also publishes licensed titles such as Avatar: Frontiers of Pandora and maintains long-running live operations for Rainbow Six Siege.

Ubisoft positions itself around two pillars it has emphasized in recent communications: open world adventures and games-as-a-service experiences. The company is also working to build more evergreen franchises, expand live features, and grow recurring revenue from back catalog and subscriptions. Its public statements highlight shared technology, cross-studio production, and a push to tighten execution on quality and predictability.

These moves frame what Ubisoft is going through: a multi-year shift toward fewer, stronger releases supported by deeper live services and a more efficient organization.

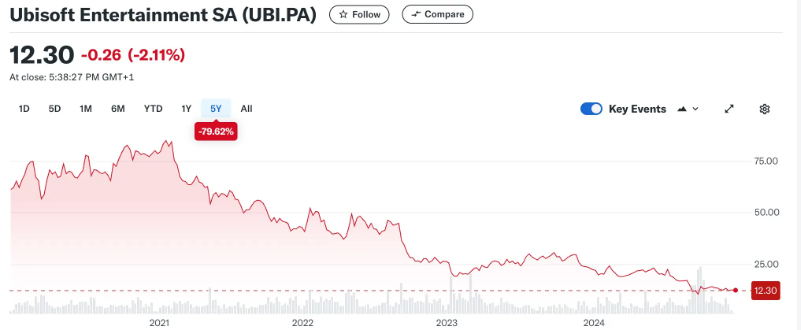

Financial Performance And Guidance

Ubisoft’s latest full-year figures, for the fiscal year ended March 31, 2025 (FY2024-25), show a mixed picture. Net bookings were about EUR 1.85 billion, slightly below internal objectives, with non-IFRS operating income near breakeven and free cash flow positive. Management cited lower-than-expected partnerships as a drag, while free cash flow benefited from tighter discipline and operating cash generation. See the company’s own release for details: Official financial report.

Headline drivers in the year included a strong flagship launch in Assassin’s Creed Shadows, steady engagement in Rainbow Six Siege, and resilient back catalog performance, alongside softer-than-expected contributions from certain partnerships and releases. Ubisoft also said it completed an initial cost reduction program slightly above a EUR 200 million objective and targeted further fixed cost reductions over the next two years.

For guidance, Ubisoft indicated that the current fiscal year (FY2025-26) is planned to be a transition year with net bookings roughly stable year over year, non-IFRS operating income around breakeven, and negative free cash flow as the organization transforms. The company expects to return to positive non-IFRS operating income and free cash flow in FY2026-27, with heavier content from major brands in FY2026-27 and FY2027-28.

In its most recent quarterly update for Q1 FY2025-26, Ubisoft reported net bookings around EUR 282 million, below guidance, citing a lower-than-expected performance for Rainbow Six Siege in the quarter. See: Official quarterly sales update.

Where figures were not published, this report notes Not disclosed.

Release Slate And Portfolio Updates

Recent Releases

-

Assassin’s Creed Shadows launched in March 2025 and was highlighted by Ubisoft for strong day-one performance and positive early player sentiment in first-party stores. It is built on an upgraded version of the Anvil engine and has received post-launch updates. Expansion content is planned within the current fiscal year.

-

Star Wars Outlaws launched in August 2024. In later financial materials, Ubisoft said sales underperformed expectations despite solid reviews and user scores in certain storefronts. The company referenced ongoing updates, a Steam launch, and a first story pack to bolster performance through the holiday period following launch.

-

XDefiant launched in 2024 as a free-to-play competitive shooter and has continued to receive updates. Specific active user numbers are Not disclosed.

-

The Crew Motorfest launched in 2023 and continued to gain momentum, with engagement metrics up year over year in recent quarters.

-

Avatar: Frontiers of Pandora, launched in late 2023, continued to attract new players and showed sequential activity gains over the company’s most recent reported quarter.

-

Rainbow Six Siege maintained regular seasonal updates as it approached a major evolution branded as Siege X.

-

Skull and Bones launched in early 2024 and remains part of the live catalog. Detailed KPIs are Not disclosed.

Notable Upcoming

-

Assassin’s Creed Shadows post-launch content, including a named expansion referenced in the financial release, planned in FY2025-26.

-

Rainbow Six Siege X, described as a major evolution with modernized maps, a full audio overhaul, deeper tactical features, and an enriched onboarding path. Ubisoft outlined free access to certain modes with premium tiers unlocking ranked and competitive modes.

-

Continued content updates for The Crew Motorfest, Rainbow Six Siege, and other back catalog titles.

Official Delays, Cancellations, Rescopes

Ubisoft stated it reviewed its pipeline between October and December of FY2024-25 and provided additional development time for some of its biggest productions to set the best conditions for success. Where specific titles or new dates were not disclosed, this report notes Not disclosed.

Live Service Health And Content Cadence

Rainbow Six Siege

Ubisoft said Rainbow Six Siege delivered year-over-year net bookings growth during FY2024-25 and reached record metrics for membership at the end of March. A Year 10 Season 1 update helped drive engagement and a record battle pass conversion rate one month after launch, according to the company. Siege X was revealed with feature upgrades, new modes, and a business model shift intended to expand the player base.

The Crew Motorfest

The Crew Motorfest continued to build engagement through new seasons and events, with activity and engagement metrics up high double digits in the latest reported quarter. Ubisoft positioned Motorfest as a key component of its back catalog growth.

Avatar: Frontiers Of Pandora

Ubisoft noted ongoing player acquisition and sequential activity gains for Avatar: Frontiers of Pandora through the latest quarter. Post-launch content and updates contributed to continued interest. Detailed revenue or active user counts are Not disclosed.

Assassin’s Creed Shadows

Ubisoft said post-launch updates were released in response to community feedback, with further content planned. The company emphasized early playtime and sentiment data following launch. Specific unit sales were Not disclosed.

Organization And Leadership Notes

-

Ubisoft said it completed an initial cost reduction program ahead of schedule and slightly above the EUR 200 million target. It plans at least EUR 100 million of additional fixed cost reductions over the next two years.

-

The company announced plans to reshape its operating model and said it would detail a new overall group organization by the end of calendar 2025. The goal is to better meet player needs, deliver higher quality, and allocate capital with more discipline.

-

Ubisoft announced the creation of a new subsidiary backed by Tencent as a core strategic partner. The subsidiary is focused on accelerating growth for three iconic IPs: Assassin’s Creed, Rainbow Six, and Far Cry. The structure includes a perpetual license arrangement and a royalty stream back to Ubisoft, with the transaction targeted to close by the end of 2025, subject to conditions.

-

Specific leadership appointments or departures beyond these structural moves are Not disclosed in the cited releases.

Strategy Signals And Operating Priorities

Flagship Franchises

Ubisoft is concentrating investment on brands with long-term potential, including Assassin’s Creed, Rainbow Six, and Far Cry. The company is steering its roadmap toward more evergreen offerings, deeper live features, and stronger quality bars, as reflected in extending development time for certain titles.

Portfolio Mix

The strategy blends premium open world adventures with games that are native to live service models. Catalog titles and live operations remain central to recurring revenue. Free-to-play pilots continue to test new formats and business models.

Subscriptions And Catalog

Ubisoft promotes access to its back catalog and new releases through subscriptions and partnerships. The company referenced partnerships in recent quarters, though noted that contributions from this channel were below expectations in the latest full year.

Technology And Production

Ubisoft emphasized upgraded technology stacks and shared tools. Assassin’s Creed Shadows was called the first installment built on a significantly upgraded Anvil engine. The company also underlines cross-studio collaboration and a more disciplined production pipeline. Public R&D discussions, such as Ubisoft La Forge’s work on narrative assistance tools, reflect ongoing investment in internal tooling and workflow improvements.

Studio Footprint And Production Pipeline

Studio Network

Ubisoft operates a distributed model with development across major hubs in Canada, the United States, France, the Nordics, Eastern Europe, and Asia. Flagship projects use a multi-studio structure, with central engine and shared services supporting content teams. Studio-level expansions or consolidations are announced selectively; many changes flow through group-level planning. Specific headcount per studio is Not disclosed.

Pipeline Structure

Ubisoft said it reviewed its pipeline in late 2024 to early 2025, chose to extend timelines for certain large productions, and prioritized a five-year lineup concentrated around its most powerful brands. Additional content for existing live titles continues to anchor engagement.

Workplace And Compliance Updates

Ubisoft reports on ethics, compliance, and risk in its annual reporting. Public materials describe code of conduct enforcement, training initiatives, and internal reporting processes. The company also highlights privacy and safety in online services, including detection and enforcement systems embedded in live titles. Specific case outcomes or investigations not disclosed publicly are outside the scope of this report.

Technology, Tools, And Production Methods

Technology And Tools

-

Engine evolution: Assassin’s Creed Shadows is built on an upgraded Anvil engine, which Ubisoft says boosts visual fidelity, physics, and environmental interactivity. The company also described an engine upgrade supporting higher content velocity in the Siege X program.

-

Shared services: Ubisoft continues to use shared builds, cross-studio tooling, and centralized services for QA, localization, and online infrastructure to manage large multi-team productions.

-

AI-assisted workflows: Ubisoft has publicly described internal tools that support writers with first-draft variations for ambient NPC lines under human review. The company frames these tools as accelerators for repetitive tasks, not replacements for creative roles.

Accessibility And Online Services

Ubisoft integrates platform-level accessibility features, localization pipelines with human review, and online moderation and reporting tools. Specific feature sets vary by title and platform.

Competitive Context And Market Factors

Ubisoft cites intense industry competition, platform and business model shifts, and the need for predictable execution. The company highlights the importance of live service reliability, evergreen content, and disciplined capital allocation. It also pointed to timing and scale of partnerships as a material factor in financial variance.

Timeline Of Key Events In The Last 12 To 18 Months

-

August 2024: Star Wars Outlaws launches. Later, Ubisoft says sales underperformed expectations despite solid reviews on certain storefronts.

-

October 2024: Ubisoft reports first-half FY2024-25, citing back catalog resilience, cost control progress, and underperformance from Star Wars Outlaws versus expectations. Additional development time is assigned to certain major productions.

-

March 2025: Ubisoft announces the creation of a new subsidiary backed by Tencent to accelerate Assassin’s Creed, Rainbow Six, and Far Cry, with a perpetual license model and royalties back to Ubisoft, targeting closing by end of 2025.

-

March 2025: Assassin’s Creed Shadows launches, with Ubisoft citing strong day-one performance and positive player sentiment in first-party stores.

-

March 2025: Rainbow Six Siege Year 10 Season 1 update drives a record battle pass conversion rate one month after launch, according to Ubisoft.

-

May 2025: Ubisoft reports FY2024-25 earnings, detailing net bookings around EUR 1.85 billion, positive free cash flow, and additional cost savings targets. Management telegraphs a new operating model announcement by year end.

-

June 2025: Siege X begins rollout with new modes, modernized maps, and an updated business model designed to broaden the community.

-

July 2025: Q1 FY2025-26 net bookings come in around EUR 282 million, below guidance, with Ubisoft citing lower-than-expected performance in Rainbow Six Siege for the quarter.

What Ubisoft Is Going Through Right Now In Plain Terms

Ubisoft is tightening focus on core brands and live services while rebuilding predictability. The last year balanced a strong launch for Assassin’s Creed Shadows and solid catalog engagement against underperforming pieces elsewhere and the need to right-size costs. The company is using this period to restructure, reduce fixed costs, and apply more time to big games before release.

On the portfolio side, Ubisoft is leaning into what it does best: large open world adventures and service-native experiences. It is upgrading tech, refining tools, and shifting business models where needed, as seen with Siege X. It is also using a new subsidiary structure to invest in three major brands with a partner while keeping long-term control and a royalty stream.

In short, what Ubisoft is going through is a transition to a leaner, more focused slate with bigger bets on fewer brands, more live depth, and stronger operating discipline.

What Stakeholders Are Saying

Chief Executive Officer Yves Guillemot called FY2024-25 challenging with mixed dynamics across the portfolio and intense competition, noting the team delivered positive free cash flow and completed an initial cost savings program. He said, in essence, that Assassin’s Creed Shadows reaffirmed the brand’s strength and that Ubisoft would announce a new operating model by year end to better meet player needs.

Management also said it reviewed the pipeline, gave more time to major productions to raise quality, and expects significant content from the largest brands in FY2026-27 and FY2027-28. The company described the Tencent-backed subsidiary as a step to build evergreen, billion-euro brand ecosystems with Ubisoft maintaining strategic control and receiving royalties.

Rumors And Market Chatter

The following items are widely reported but not officially confirmed. They are included here strictly as market chatter.

-

Switch Successor Launch Window Lineup

Reports suggest Ubisoft may align multiple titles or ports for a next-generation Nintendo system window.

Status: Unconfirmed. Reported by multiple outlets. -

New Far Cry Mainline Timing

Several reports speculate on the next Far Cry mainline entry window and design direction.

Status: Unconfirmed. Under discussion. -

Assassin’s Creed Multiplayer Project Scheduling

Coverage has suggested shifts in timing for multiplayer-focused Assassin’s Creed initiatives.

Status: Unconfirmed. Reported by multiple outlets.

If an item is later confirmed by Ubisoft, it would move into the verified sections of this report.

Risks And Opportunities

Risks

-

Execution risk on fewer, larger releases and live overhauls.

-

Intense competition across open world and competitive shooter genres.

-

Dependence on back catalog bookings and partnerships that can vary by timing.

-

Cost and complexity of cross-generation development and online operations.

-

Near-term free cash flow pressure during the transformation period.

Opportunities

-

Strength in flagship brands with large engaged communities.

-

Engine and tooling upgrades that can improve quality and content velocity.

-

Restructuring to reduce fixed costs and sharpen focus.

-

The new subsidiary structure, which can add investment capacity to three core IPs and reduce consolidated net debt upon closing.

-

Siege X as a pathway to expand the player base and modernize a long-running live service.

Outlook And What To Watch Next

-

Planned organization announcement by the end of 2025, outlining the new operating model.

-

Closing of the Tencent-backed subsidiary transaction by year end, subject to conditions.

-

Post-launch content for Assassin’s Creed Shadows, including a named expansion expected in FY2025-26.

-

Siege X rollout milestones, including mode access changes and content cadence.

-

Ongoing seasons and updates for The Crew Motorfest, Rainbow Six Siege, and other live titles.

-

Next scheduled financial updates per Ubisoft’s usual quarterly cadence, with guidance commentary subject to change.

How We Verified This Report

All facts in this report were drawn from Ubisoft’s official earnings materials, corporate communications, newsroom posts, and on-the-record press reporting, with cross checks for key dates, figures, and claims. Where Ubisoft did not disclose data, this report states Not disclosed. Rumors were kept separate and labeled as unconfirmed.

Conclusion

The facts point to a company in a controlled pivot. Ubisoft is concentrating on its strongest brands, investing in tech and live models, and reorganizing to be leaner and more predictable. The last year combined a standout launch in Assassin’s Creed Shadows and steady catalog engagement with softer performance elsewhere and the need to bolster execution. Management is extending timelines for big games, cutting fixed costs, and preparing a new operating model. A Tencent-backed subsidiary focused on three core IPs is set to add investment capacity and reduce consolidated net debt once closed.